Is the Analog Chip Industry Entering a New Growth Cycle?

- Technology & Innovation

By

- Updated February 8, 2026

After several years of downturn, the analog chip industry is showing signs of recovery. A price rebound that started in memory chips has helped stabilize analog chip prices. Earnings previews for 2025 show that many analog chip companies expect strong growth or a return to profit.

As of February 4, 2026, 27 A share analog chip design companies had released 2025 earnings forecasts. Among them, 15 expect losses, though most report narrower losses. Twelve expect profits, and some project profit to more than double.

Following oversupply and intense price competition from 2022 to 2024, the sector continued to recover in 2025. Stock prices of SG Micro (300661.SZ), Novosense (688052.SH), and 3Peak (688536.SH) hit cyclical lows in February, April, and September 2024, then entered an upward trend in 2025. All three expanded scale and product lines through horizontal mergers and acquisitions.

Institutions expect the analog chip sector to remain active in the coming years, and believe one or more Chinese firms could eventually gain global influence.

Table: 2025 Net Profit in USD

| Stock Code | Company (Chinese + English) | 2025 Net Profit (USD) | YoY Change |

|---|---|---|---|

| 603375.SH | 盛景微 (Holyview Microelectronics) | $1.43M–$2.14M | Down 34.53%–56.35% |

| 603068.SH | 博通集成 (Beken Corporation) | $2.46M–$3.68M | Turned loss into profit |

| 688270.SH | 臻镭科技 (Great Microwave Technology) | $17.57M–$20.71M | Up 529.64%–642.26% |

| 688536.SH | 思瑞浦 (3Peak) | $23.57M–$26.29M | Turned loss into profit; profit increase 36,222–38,122 (10k yuan) ≈ $51.75M–$54.46M |

| 688286.SH | 敏芯股份 (MEMSensing) | $4.00M–$5.71M | Turned loss into profit; profit increase 6,323.57–7,523.57 (10k yuan) ≈ $9.03M–$10.75M |

| 688601.SH | 力芯微 (Wuxi ETEK Microelectronics) | $4.88M–$5.31M | Down 70.49%–72.87% |

| 688391.SH | 钜泉科技 (Hi Trend Technology) | $5.43M–$7.14M | Down 46.58%–59.4% |

| 688798.SH | 艾为电子 (Awinic Technology) | $42.86M–$47.14M | Up 17.7%–29.47% |

| 688045.SH | 必易微 (Kiwi Instruments) | $1.29M–$1.93M | Turned loss into profit; profit increase 2,617.09–3,067.09 (10k yuan) ≈ $3.74M–$4.38M |

| 688508.SH | 芯朋微 (Chipown) | ~$26.43M | Up about 66% |

| 688368.SH | 晶丰明源 (Bright Power Semiconductor) | ~$5.14M | Turned loss into profit; up about 208.92% |

| 688153.SH | 唯捷创芯 (Vanchip) | ~$6.43M | Turned loss into profit; profit increase ~6,872.51 (10k yuan) ≈ ~$9.82M |

Faster earnings repair and easing price competition

Recent 2025 earnings previews are generally positive.

3Peak forecasts 2025 revenue of 2.13 to 2.15 billion yuan, up 74.66 percent to 76.30 percent year on year. Non recurring net profit attributable to shareholders is expected at 105 to 126 million yuan, an increase of 386 to 407 million yuan from the previous year. Growth came from markets such as automotive, AI servers, optical modules, new energy including photovoltaic inverters and energy storage, power modules, power grids, industrial control, test and measurement, and home appliances. Integration with its acquisition target Shenzhen Chuangxin Microelectronics helped it build presence in industrial, automotive, communications, and consumer electronics. Higher shipments, revenue growth, and cost control improved overall efficiency.

Novosense expects 2025 revenue of 3.3 to 3.4 billion yuan, up 68.34 percent to 73.45 percent year on year. Non recurring net profit is still negative at minus 290 to minus 240 million yuan, but losses are expected to narrow by 167 to 217 million yuan. The company had continuous losses in 2023, 2024, and the first three quarters of 2025. In its Hong Kong listing materials, it disclosed that gross margin fell from 48.5 percent in 2022 to 28.0 percent in 2024 due to stronger competition and pricing pressure from international leaders.

In mid September 2025, China’s Ministry of Commerce launched an anti dumping investigation into certain analog chips imported from the United States, including general interface and gate driver chips. Evidence showed that from 2022 to 2024, import volume from the US rose 37 percent while prices fell 52 percent, suppressing domestic prices and harming local producers.

At the same time, semiconductor price increases over the past two years have spread beyond memory to other segments. Analog firms are gradually moving away from price wars toward broader price increases. Texas Instruments, a global analog leader, started raising prices in the second half of 2025.

The World Semiconductor Trade Statistics organization forecasts that the analog market will grow 6.7 percent in 2025 to reach 84.34 billion US dollars, with steady long term prospects.

CITIC Construction Investment believes that strategic shifts by overseas leaders have eased downward price pressure, helping Chinese firms recover profits and expand share. Localization still has large room to grow, and at least one Chinese company could become globally competitive.

Rising demand for analog chips

Analog chips process continuous signals. Major types include linear products, converters, isolation and interface products, RF and microwave devices, ASICs, power management chips, and driver chips. They are broadly divided into signal chain chips and power management chips. Power management handles conversion, distribution, and monitoring of electricity, while signal chain chips convert real world inputs such as light, magnetic fields, temperature, and sound into digital signals.

As the semiconductor industry moves toward high performance, low power, and high reliability, the system value of analog chips is increasing. Expansion of AI computing infrastructure, growth of electric and smart vehicles, and intelligent upgrades in industry and energy systems all raise both volume and performance requirements for analog chips.

Frost and Sullivan forecasts that China’s network and computing analog IC market will reach 115.6 billion yuan by 2029, with a 14.6 percent compound annual growth rate from 2025 to 2029. SG Micro covers both signal chain and power management, supplying efficient high current power for CPUs and microprocessors and high precision clock management for servers and high speed interconnect.

According to Novosense’s Hong Kong prospectus, automotive analog chips are among the fastest growing and most technically demanding areas. In 2024, the average analog chip value per intelligent new energy vehicle was 1,500 to 2,800 yuan. By 2029, this is expected to rise to 2,200 to 4,000 yuan. The automotive analog chip market was 37.1 billion yuan in 2024 and is projected to reach 85.8 billion yuan in 2029.

Novosense’s automotive grade products are used in new energy vehicle power systems, thermal management, servers, and industry. By 2024 sales volume, its chips were used in China’s top ten domestic new energy vehicle models. 3Peak focuses on power management and in 2025 launched automotive grade low voltage monitoring chips with watchdog and manual reset, as well as 2A and 4A high side switches for ADAS and body electronics.

Mergers, R&D, and manufacturing trends

Analog chips emphasize precision, linearity, stability, and low power rather than extreme speed. Their design relies heavily on experience, has fewer automated tools, and requires long testing cycles, which creates high barriers and long talent training periods. As a result, companies maintain high R&D spending even when performance fluctuates.

- 3Peak invested 268 million yuan in R&D in the first half of 2025, 28.29 percent of revenue, with 28 projects across industrial, communications, medical, new energy vehicles, photovoltaics, storage, and consumer electronics. Its automotive products are used in intelligent driving, body control, power systems, in vehicle video, and lighting.

- SG Micro has about 6,600 products across 38 categories. R&D spending rose from 550 million yuan to 810 million yuan from 2023 to the first three quarters of 2025, about 26.54 percent to 29.26 percent of revenue.

- Novosense spent 23.74 percent to 49.86 percent of revenue on R&D from 2023 to the first three quarters of 2025, and is expanding into humanoid robots and eVTOL with encoders and position sensors.

Because analog chips are closely tied to applications, stable supply relationships can create long term customer stickiness. Despite rapid progress by Chinese firms, localization rates remain low and the market is still led by foreign giants such as Texas Instruments, Analog Devices, Infineon, and STMicroelectronics.

Mergers and acquisitions are a key growth path. 3Peak acquired 100 percent of Chuangxin Micro in 2024. SG Micro acquired companies including Ganrui Intelligence. Novosense acquired MagnTek to strengthen magnetic sensors and added more than 1,000 new product stock keeping units.

Table: Major Analog Chip Industry M&A Events in the Past Decade

| Year | Deal Value (USD 100M) | Acquirer | Target | Main Product Lines |

|---|---|---|---|---|

| 2016 | 8 | 微芯 (Microchip Technology) | 麦瑞半导体 (Microsemi) | Linear analog chips, power management chips |

| 2017 | 148 | 亚德诺 (Analog Devices, ADI) | 凌特 (Linear Technology) | Data converters, power management chips, interfaces, RF devices |

| 2017 | 24 | 安森美 (ON Semiconductor) | 快捷半导体 (Fairchild Semiconductor) | Power management chips and power semiconductors |

| 2018 | 31 | 瑞萨 (Renesas) | 英特矽尔 (Intersil) | Power management chips and high performance analog chips |

| 2019 | 67 | 瑞萨 (Renesas) | 集成设备技术 (Integrated Device Technology, IDT) | Storage, storage controllers, optical interconnect components |

| 2021 | 210 | 亚德诺 (Analog Devices, ADI) | 美信 (Maxim Integrated) | Analog chips, power management chips |

| 2021 | 57 | 瑞萨 (Renesas) | 戴尔格半导体 (Dialog Semiconductor) | Power management chips, wireless connectivity devices |

| 2023 | Not disclosed | 瑞萨 (Renesas) | Panthronics | High performance wireless chips, NFC chips and components |

| 2023 | 8.3 | 英飞凌 (Infineon) | GaN Systems | GaN power conversion solutions |

| 2023 | 4.3 | 安森美 (ON Semiconductor) | 格芯 (GlobalFoundries) | Wafer fab (manufacturing capacity) |

| 2024 | 59 | 瑞萨 (Renesas) | Altium | PCB design software |

On manufacturing, global analog capacity is still concentrated on 8 inch wafers using mature 28 nm and above processes. High end applications such as automotive electronics and AI server power are pushing toward more integration, higher performance, and higher reliability. This drives upgrades to 90 nm, 65 nm, and 40 nm class processes, new high voltage BCD processes with lower on resistance, and advanced packaging like WLCSP, QFN, and SiP. The industry is also accelerating migration to 12 inch wafers.

To fund growth, some firms issue convertible bonds. Southchip Technology applied on January 16, 2026 to issue up to 1.587 billion yuan in convertible bonds for power management, automotive, and industrial sensor and control chips. Its projects are expected to achieve after tax internal rates of return of 15.10 percent to 15.64 percent, with payback periods of 6.64 to 6.74 years. Awinic issued convertible bonds on January 22, raising a net 1.886 billion yuan for global R&D centers and AI, automotive, and motion control chips, with expected after tax returns of 18.51 percent to 19.76 percent and payback periods of 6.02 to 6.42 years.

Overall, the data suggest the analog chip industry is moving out of its downturn, supported by recovering prices, strong demand from AI and vehicles, and sustained investment in R&D and capacity. Whether Chinese firms can translate this into global leadership remains an open question.

Source: Hexun

China is accelerating 6G research and industrial planning. Many listed companies are moving into key 6G technologies, and global competition over 6G standards is intensifying. On January 13, 2026, the China Economic Medi...

- 08/02/2026 in Technology & Innovation

China’s humanoid robot ecosystem is rapidly expanding, driven by national strategic priorities and venture capital investment. Leading companies range from established robotics innovators to fast-growing startups. While...

- 01/01/2026 in Technology & Innovation

China’s Unitree Robotics has begun public beta testing of what it calls the world’s first app store built specifically for humanoid robots. The platform aims to standardize and modularize robot functions, making advanced...

- 23/12/2025 in Technology & Innovation

Chinese robotics startup TARS has unveiled two new humanoid robot prototypes that highlight its focus on advanced physical intelligence and precision applications such as wire harness assembly and embroidery, tasks that...

- 22/12/2025 in Technology & Innovation

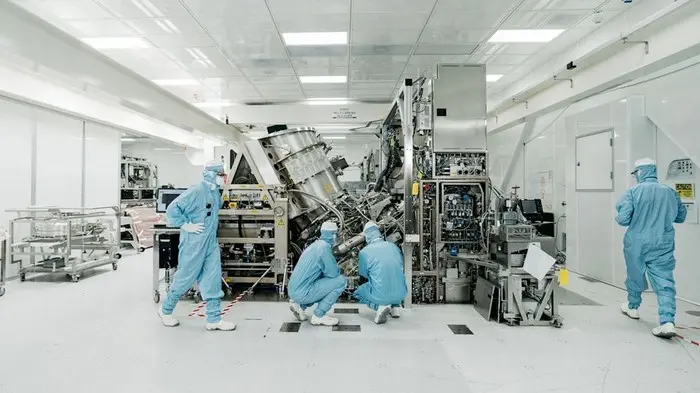

According to a Reuters investigation dated December 17, China has built and is testing its first domestic prototype of an extreme ultraviolet (EUV) lithography machine in a high-security laboratory in Shenzhen. The proto...

- 22/12/2025 in Technology & Innovation

According to a company press release, iRobot, widely known as the pioneer of robot vacuum cleaners, filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the District of Delaware on Decembe...

- 20/12/2025 in Technology & Innovation

In response to increasingly dynamic manufacturing environments, Chinese intelligent robotics company Huiwen has launched the iBenX series of autonomous mobile robots (AMRs) to provide flexible, lightweight, and adaptable...

- 12/12/2025 in Business & Industry

UBTECH Robotics and the Beijing Humanoid Robot Innovation Center have jointly established Beijing Tianyou Robotics Co., Ltd., with UBTECH holding a 65% stake and the innovation center holding 35%. The joint venture aims...

- 12/12/2025 in Technology & Innovation